Company Tax Rates are not the reason that economic growth is sluggish in the current global economy. Lowering Company Tax is not a priority

While cutting company tax rates to attract and keep businesses in the country is currently an attractive idea, it is without proper theoretical justification.

Company tax on Domestic Earnings

If I can earn 2% profit on domestic sales of $1b = $20m, and pay 10% tax, then the net income I can earn is $18m. However, if I can earn 5% profit on sales of $1b = $50m, and pay 25% tax, then the net income I can earn is $37.5m. I am much better off if I can increase my profit margin, rather than seeking lower company tax rates.

If imports are subjected to a 5% tariff, then this situation is more than possible.

Furthermore, if I need a 5% profit in order to profitably invest, then I won’t invest in a high-cost country. This is closer to the real situation in the world, where there is not a problem with corporate tax rates, but there is nothing in which to invest in the West. Competition from the East is driving away all investment opportunities, which is actually also hurting the East, since it markets are drying up.

The current situation is both appalling and lacking in a theoretical justification, despite the dominance of this ideology among the elites. If they don’t wake up, they will lose all influence in the West, as is beginning to happen in the USA, France, and even in Australia.

Global Trade Reform is required

As Donald Trump has demonstrated, the West’s voters are calling for a trade realignment. None of the main-stream parties are really on board (even the Republicans are running on Trump’s coat-tails and are not “true believers”). Indeed, President Trump has created a catalyst for global trade reform. The USA could use this opportunity to implement reform via WTO that will work for both developed and developing nations. Yet it remains to be seen whether Global Trade Reform will happen.

Since this not now (May 2018) likely to happen, governments need to look at smaller changes that they can make. For example, in Australia, the government could introduce an Overseas Out-Sourcing Tax. This should be levied to cover the additional costs that Australian companies have to pay for locally sourced labour. These costs are: Superannuation Levy 9.5%, payroll tax 5%, and leave payments 5%+. That then adds to a 20% levy that should be charged for every company purchasing services from overseas – it is just a case of moving towards the (impossible to achieve) aim of a “level playing field” (I use their terminology against my opponents). This can be easily collected via a self-assessment system, added into the BAS.

Company Tax on Export Earnings

In regard to exports, why would I set up in any high-cost country to export to the world? The reason must be the quality of the staff that I could employ, and the higher export sales (or lower final costs) I can achieve. Let us follow that scenario.

If I can earn 2% profit on export sales of $1b = $20m, and pay 10% tax, my net income will be $18m. However, if I can earn 2% profit on export sales of $2b = $40m, and pay 25% tax, my income will be $30m. If this were the situation, my decision to move my business to a high-cost country would be entirely rational on the grounds of higher potential net profit after tax, even with a higher rate of tax.

Surely, few can dispute the significant advantages of more skilled staff. If anyone wishes to do so, please explain why tech companies are located in high wages, high taxes, California, rather than in Bangladesh, with low wages, and a tax holiday.

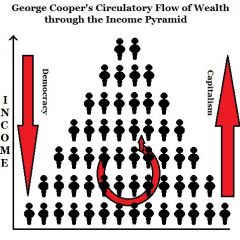

Domestic Demand drives most Business Income

Most businesses primarily service domestic demand. If that fact were given more attention, the current economic malaise would be fixed overnight.

Nevertheless, mainstream leaders like to mix with the (export) winners, not with domestic players. Their obsession with a particular economic ideology will see the world being changed, but not in the direction they are planning. Lowering company tax should NOT be a first priority.